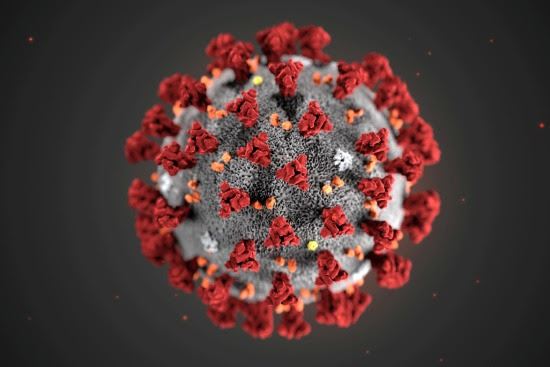

Now that India is bracing for relaxation of nationwide lockdown imposed in the wake of coronavirus pandemic, economists and world renowned Indian brains had a discussion on almost all the aspects of Indian life from e-commerce to gold-buying spree to frugal mindset to sanitation consciousness.

Here are some takeaway points:

General Outlook

- India seems to have suppressed the curve for long but not now with 1.6 million cases and more than 36,000 deaths so far. It looks like it might escalate further.

- Possibility of W Curve – There is a good chance of re-occurrence of the virus, which could see a possibility of regular lockdowns. Businesses need to plan accordingly.

- Capital inflow will look for countries that are less battered. Western economies are badly battered while countries like India, Indonesia, among others are not so battered.

- Emotional and Economic backlash against China is expected. Already, countries and companies are working on strategy to pivot away from China as part of their supply chains. Japan has announced packages for it’s companies bringing back manufacturing home. Businesses need to keep this in mind and work accordingly.

Discretionary Spending

- For individuals, health and safety will become No.1 on their agenda from the 3rd of 4th place. There will be more spending on this and reduction in other discretionary spending.

- The ticket size of spending will drop for a while. People will spend on cheaper goods than on expensive goods, or delay spending for a while.

- Extreme acceleration in digital economy — home education, home entertainment, home fitness, etc

- Loyalty shock: People will be less loyal towards brands as other aspects will take over. People will switch brands faster due to various other concerns like safety.

- General Trust deficit among stakeholders like vendors, customers, employees, borrowers, banks, etc. visible. Banks will have trust deficit with borrowers, companies will have trust deficit with suppliers, and it goes on.

Liquidity and P&L

- Segregate Good Costs and Bad Costs

- Good costs (Eg. Digitization, tech costs, digital marketing, best employees, etc) need to be insulated and protected

- Bad Costs (Eg. Fancy office, unnecessary spending, bad performers, traditional working methods) need to be ruthlessly eliminated. Companies will not entertain or be emotional about non-core businesses.

- Be Frugal – Not necessary to have fancy office, fancy cars, excess employee strength, etc. Companies tend to remove all the flab and be lean.

- Maintain Good behaviour – Have frank and open conversation with all stakeholders like suppliers, employees, etc and try to find the middle ground, so that the burden can be shared justly.

- Be Future Ready – In this crisis, there will be winners and there will be losers. Those who re-orient their strategy will be winners.

Govt Stimulus

- Economy was in poor shape even before Covid. The govt has little leeway to provide large stimulus.

- Govt earns about $60-70 billion a week from taxes. Imagine what a hit a 5-week lockdown will have. Size of Indian economy is about $3 Trillion. In some scenarios, it is predicted that Govt could take a hit of nearly $1 Trillion.

- Inequality has already sharpened. The gap between rich and poor has further increased. Govt needs to concentrate on mass health and mass welfare. If not, 200 million people could sink into poverty.

- Govt must explore printing currency (Quantitative easing), but there are limitations here. It has side effects like inflation. Rich countries have more leeway for such quantitative easing.

- Govt will focus on more capital from outside.

Result of backlash against China

- Internationally, and domestically there is an emotional and economic backlash against China due to border clashes recently.

- Businesses with supply chains passing through China will need to insulate themselves and build alternatives.

- India and Indian businesses need to try to become the contract manufacturer of the world, just like China is. India needs to make use of this opportunity.

- All big wealth funds and sovereign funds will be awash with liquidity. This liquidity needs to be attracted to India.

- In every sector, there are good and bad companies. Management has to invest correctly in manufacturing and modern tech, be honest and fair to all stakeholders, etc., Those companies with good management and displaying good behaviour will come out victorious.

Export Business

- Indian exporters need to build trust. They need to live up to promises made. They need to deliver on time and deliver the promised quality. They shouldn’t make incorrect promises just to get more business.

- Bangladesh export business has built trust and a good reputation. Despite a chequered past (low quality, human rights issues, etc) they have managed to overcome and are winning.

Wholesale, Retail, etc.

- More people will prefer to buy from retail stores where there is perception of safety (Eg. Sanitation, cleanliness, crowds, etc). They will move away from malls and mega markets. Many will move towards online stores. Wholesale suppliers also need to concentrate on such retailers.

- Customers also need to be ring-fenced.

- A high end restaurant in Delhi is giving 40% of bill value as a gift coupon to be used anytime up to December 2020.

- Car companies are giving buy back offers, in case the customer loses his job in the next one year.

- Pricing needs to be re-approached. People are looking for cheaper prices or cheaper good.

Brick & Mortar in Discretionary Spends

- Cinemas could take a big hit in the near future. Entertainment could move to home.

- Because of this, cafes and restaurants might see some increase in business. Many chains are implementing measures like social distancing like lesser furniture, etc, to build confidence to consumers.

- Smaller retailers need to send a message of safety. Eg: Have sanitisers, put up notice of no Covid positive employee found in the store, maintain social distancing, etc.

- Since travel and tourism will take a big hit, connected purchases will also shift. Purchases that happened abroad will happen at home. (Eg. Electronics, Luxury goods and apparel, etc.,). But travel related purchases will drop.

Real Estate

- Indian real estate economy is sitting on a huge inventory with a huge cost-of-carry

- The industry is highly leveraged with low margins.

- Unsold inventory is considered an appreciating asset, but might turn out to be a flawed view.

- Market was already overdue for a huge reset, which will be accelerated by the pandemic.

- Also, the sharing and co-working space could be hit as more businesses try to have their own smaller spaces and more WFH employees.

Jewellery

- Gold-as-an-asset could see appreciation.

- Jewelry, as a discretionary spend, will take a hit.

- The Indian wedding industry will take a hit, as social distancing, cost consciousness, travel avoidance, etc., will prevent fat weddings, destination weddings, etc. This will hit all connected industries. (Eg. Silk, partywear, etc)

Financial Markets

- There will be value destruction and value creation in different companies in the same sector.

- High Debt low margin companies will find it difficult. (indicates risky or unscrupulous management)

- High Debt high margin companies could be rewarded, but caution needs to be exercised. (may indicate sharp or dynamic management)

- No debt high margin companies are best rewarded now.

- Know more about the CEO and management and their actions and activities. (Eg: 3 branches of Starbucks were kept open in India for last few days. The CEO of Starbucks India sat in the Fort (Mumbai) branch throughout the day to give his employees confidence and motivation).

- New tech unicorns will be born. Those involved in cyber security, cloud services, online education services, etc.

Forex Markets

- No doomsday scenario (i.e. Dollar will become 90 rupees etc). Such scenarios don’t seem realistic

- Govt should be buying as much oil as possible, as such prices may never be seen in the future of oil.

- As the western economies are more battered and Indian economy too faces same fate, depending on the spread of the disease in India.

- Watch out for sharp spikes in the market. Better to avoid the spikes.

Outlook for near future

- Large Companies survive.

- Huge concern seen for employees. Companies are paying the employees even when closed.

- HUL decided not to cut a single rupee for their suppliers, service providers, etc. No haircuts.

- Safety of employees and customers is becoming a major point of focus.

- This is possible because they have reserves of funds, etc that have been built up over the years.

Medium and Small businesses

- They have to work with thin capital reserves. Excess capital is taken out of the business and applied into personal assets.

- Small businesses take out the surplus and purchase personal assets instead of re-investing in the business. There are various factors and motivations here.

- Because of this, they are unable to meet the cash expenses of even the next month.

- A high end restaurant chain in Delhi (with Rs.40 crore annual turnover) is unable to pay the salaries of the current month as it has no liquid reserve. Owner has invested in personal assets like house in London, etc.

- Medium and Small business need to have a look at how they can build some business reserves to endure such disruptions.

‘Force Majeure’ in Contracts

- Should force majeure clauses be triggerd in various contracts like rent, supply, etc? It will lead to litigation, but there is no point in getting into litigation now.

- All parties have been affected by the crisis. The tenants, the landlords, the lenders/financiers, etc.

- Parties need to sit across the table and find a common ground and mutually decide upon the costs, rentals, etc. Burden has to be shared.

Work From Home Scenario

- It is possible for lot of employees to not visit the office and still be productive.

- In one corporate office, it is found that it is enough that only 30% staff stay in the office. Others can be connected from homes. This leads to lesser commute expense, stress of the commute, time wasted, etc.,

- Parents can take care of children more effectively while Working From Home. There can be dark hours when no calls will be made.

Optimism

As per a McKinsey survey of entrepreneurs released in May, 53% of Indian entrepreneurs are optimistic, while only 25% of Japanese entrepreneurs are optimistic. Now it’s the equally bad everywhere.