The world’s first 35-year day or night solar contract (ACWA Power’s with DEWA in Dubai) also had a record-low price for solar with storage – of just 7.3 cents per kWh.

Energy developers always look to find ways to structure deals to reduce their costs. A key task in developing utility-scale renewable energy projects is finding every possible way to reduce the price at which you must sell power to make a project pencil out financially.

The advantage of any renewable energy like solar and wind is that with no future fuel purchases, there is no uncertain future expense, so being able to guarantee a set price over as long as possible would seem to leverage that advantage.

Normally solar contracts are only for 20 to 25 years. But in 2017, ACWA Power, a developer that is no stranger to innovative deal structures, applied out-of-the-box thinking on contract design to bid a record low price for solar with storage of just 7.3 cents per kilowatt hour for DEWA, in Dubai.

This ACWA Power PPA marked the first-ever 35-year contract for Concentrated Solar Power (CSP), the thermal form of solar that can operate a power block from its energy storage.

With a longer contract, the costs incurred in developing and permitting any new income-generating projects can be put off while revenue continues, so there are more years of income generation to amortize the upfront costs. But how much did it actually reduce the price?

ETH Zürich Professor of Renewable Energy Policy Johan Lilliestam has calculated, in a paper online at Renewable Energy Focus, that as much as 2 cents per kWh was knocked off the bid in ACWA Power’s DEWA bid in Dubai.

In Concentrating solar power for less than USD 0.07 per kWh: finally the breakthrough? Lilliestam together with co-author Robert Pitz-Paal, co-director of the Institute of Solar Research at the German Aerospace Centre (DLR) attribute the cost reduction in part to the unusually long 35-year contract.

The paper states: “…with a more standard 20-year PPA, the LCOE would be USD 0.106 per kWh, which is about the same as declared by many Chinese stations under construction [7]. The long PPA duration thus directly reduces the LCOE by some 2 cents per kWh; in addition, it could help de-risking the investment by giving a very long-term perspective for investors, thus reducing the cost of capital.”

But what additional costs might be incurred over a longer operating life?

In all energy-generating technologies, engineers must design components for a specific lifespan and have to prove that components will not fail within that time. Insurers guarantee components for a set time. The agreed 20-year design lifetime means engineers can design to meet one consistent requirement, ensuring that new components can be guaranteed to work reliably – and be insured – for that period.

Would the cost of replacing components outweigh the benefit of a 35-year contract? SENER knows what’s involved in designing a project for greater longevity, as the engineering and construction firm for the 510 MW ACWA Power CSP project in Morocco, NOOR I,II and III.

SENER has been technology provider and contractor for 29 CSP projects and in three of those, it provided – roughly – all the technology and half the EPC (Engineering, procurement, and construction).

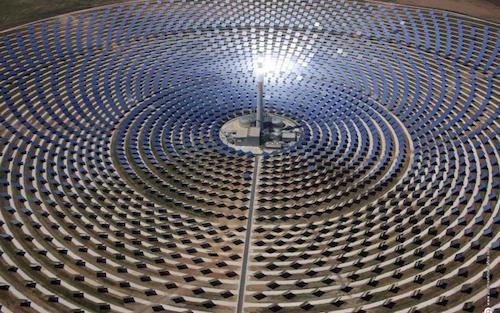

SENER’s Gemasolar CSP project in Spain, the world’s first commercial solar tower, has operated with its day and night solar successfully since being grid-connected in 2011.

“I wouldn’t say there is a major problem for designing a plant for 35 years,” SENER Performance Guarantee Manager Sergio Relloso said. “In our plants we designed the components to last for 25 years and it is completely possible to last 35 years without a problem.”

Most of the expenses would fall under normal O&M costs. However, Relloso cautioned that higher O&M costs would be expected towards the end, for example in major equipment like the steam generators in the power block. But many of the expenses he described would be the normal O&M expenses, such as in the thermal energy storage system that enables CSP to generate solar at night.

“The HTF for example; we normally replace a small quantity year-by-year in a trough project just because with HTF there is some degradation,” he pointed out. ??”This is not the case with the salts in a tower project, because there you don’t have such a high temperature near the degradation limit for the salts which top out at 565°C, while their limit is 600ºC.”

ACWA Power’s 35-year DEWA project will combine both trough (600 MW) and tower (100 MW) technologies. In overall durability, mirrors, or heliostats – in both technologies – would see negligible degradation, Relloso said.

“We are not seeing any measurable degradation in our plants in mirrors; they have operated very well and normally the mirrors last a long time,” Relloso said, referencing SEGS.

“Mirrors have had a really good track record at SEGS. You would replace year by year the small number of mirrors that are broken maybe in a high wind event or during maintenance tasks. But the percentage of breakage of mirrors is in the range of .1% to .3% of mirrors in a year – it is a very normal operation to replace mirrors in a CSP plant.”

In a trough project, the receiver tubes that run along the length of the parabolic mirrors would have a higher replacement rate, he said, because “the receiver tubes in a trough plant are not as simple as the mirrors. They could be subjected to more degradation.”

But in both tower and trough technologies, Relloso said that all the metal components themselves would last – from the heliostat structures in the solar field to the pipe racks in the power block, as everything is adequately protected and designed for 35 years.

With the longer period at a known price, ACWA Power’s interesting contract design leverages the advantage of solar power generation; that its costs are more predictable over the long term than fossil energy, as the fuel is free.

With its ability to dispatch its power whenever needed, solar thermal energy competes directly with natural gas which is also a dispatchable form of thermal generation. Since CSP seems well suited to a 35-year lifespan, if the benefits outweigh the costs, longer contracts could enable lower costs going forward.